The commercial landscape is challenged by the concept of risk vs reward. For any initiative, to mitigate the commercial risk and protect the reward, detailed estimates and cost plans are developed for funding approval.

The challenge is how to cap the price point elasticity while enabling the fluidity of services i.e. balancing the supply and demand need when sourcing services.

What’s the difference between estimating & cost planning?

A cost estimate is an assessment or approximation of the likely costs of an initiative with an indication as to the degree of accuracy, usually +/- percent.

A cost plan determines the fiscal feasibility of an initiative. This is done by setting the lifecycle budgets and cost controls to manage the delivery and quality of the initiative’s outcomes over a set timeframe.

Cost plans are living artefacts, just like project management plans. They must be managed throughout the lifecycle of any initiative in any industry.

Consumption of Services Economy Context

To compare and contrast the sourcing of future services, one needs to appreciate the significant change in the cost of money over time. In the past, sourcing was capital intensive with up-front costs and less intensive throughout the lifecycle of the service. Whereas in the future services economy, costs become flatter but at a higher monthly/annual price point.

Today:

- CAPEX/project expense: the costs to buy and implement infrastructure and services can be significant and are usually known … Scope x Time = Cost. Or Item x Unit Rate x Unit Qty = Price, etc.

- OPEX: usually static and predictable on a monthly basis where the change is reflective of volume increase, often called a Resource Unit. The annual price is usually incremented to an index such as CPI or Average Weekly Earnings (AWE) – published by the Australian Bureau of Statistics etc.

- Variables: usually driven by time, quantity and performance (SLAs) metrics with known price break points (volume discounts) or increased/decreased unit cost once a pre-agreed threshold is reached. Transition from one supplier to another is difficult and often contract bound with a fixed and/or minimum term.

- Agreement type: typically a deal that considers Risk and Reward, followed by a contract.

Future:

- CAPEX/project expense: low input costs to fund management of implementing the service (common examples of technology in the form of XaaS for Network, Compute, Storage, or Applications) … most Capex type expenses can be deferred to Opex.

- OPEX: fluid with charges on a peak or average usage basis per day/month/year. Can scale to meet unusual demands for marketing campaigns or special events driven by customer demand e.g. school HSC results. Pricing algorithms and marketplace sourcing options.

- Variables: pay per usage usually driven by time, quantity and performance metrics (i.e. SLAs). Transition from one supplier to another is fluid and driven by price and past performance – with no fixed or minimum term.

- Agreement types –

- on demand – pay as you go

- up-front subscription

- pre-paid

- per use – consumption

- introduction of broker as an intermediary between service consumers and providers

Future Considerations

There are many considerations when transitioning or transforming services to a consumption economy, some key points are:

- sourcing strategies

- risk

- governance

- definition of pricing algorithms

- consumption limits and break-points – who controls the tap?

- definition of the services (performance, availability, resilience to events etc)

- how will disaster recovery and business continuity look?

- cost to manage – which parts of the organisation will change in how they deal with future sourcing and management of services?

Technology Services Transformation Considerations – Cloud context:

When one normalises or compares the costs of traditional technology services deployment to a transformed utility model, the cost of the services is one of a number of inputs that derive the

Total Cost of Ownership (TCO).

The Financial Conduct Authority (UK) guidance for firms that are outsourcing to the ‘cloud’ and other third-party IT services lists several areas of interest that regulated firms (such as banks) should consider when using cloud-based services, including how firms should discharge oversight obligations:

- legal and Regulatory Considerations

- risk Management

- international Standards

- oversight of Service Provider

- data Security

- data Protection

- effective Access to Data

- access to Business Premises

- relationships Among Service Providers

- change Management

- continuity and Business Planning

- resolution (e., treatment during a dissolution or insolvency event)

- exit Plan

For commodity and low risk services, the considerations above are not as onerous as one would expect for business-critical transactional systems where movement of data and control can add considerable cost to a basic consumption service.

What does the future marketplace look like and what will change?

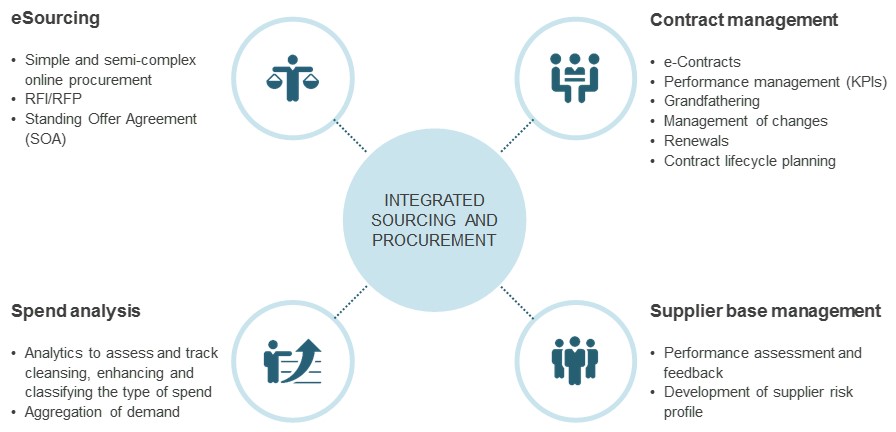

The future not only changes what and how we consume and pay for services, but also how we procure, manage and control the consumption of services. As per the diagram below, the key areas that will be impacted are in sourcing, contract, supplier and spend management – this is often called the iceberg below the water.

To insource, outsource or best source

The key components that drive decisions and price are the importance to the business as a differentiator and the competitive positioning of the service.

The price point is significantly higher when one sources critical commodities and differentiators to when one is sourcing non-critical commodities and differentiators. Often the decision is to eliminate and/or simplify these services driven by price point.

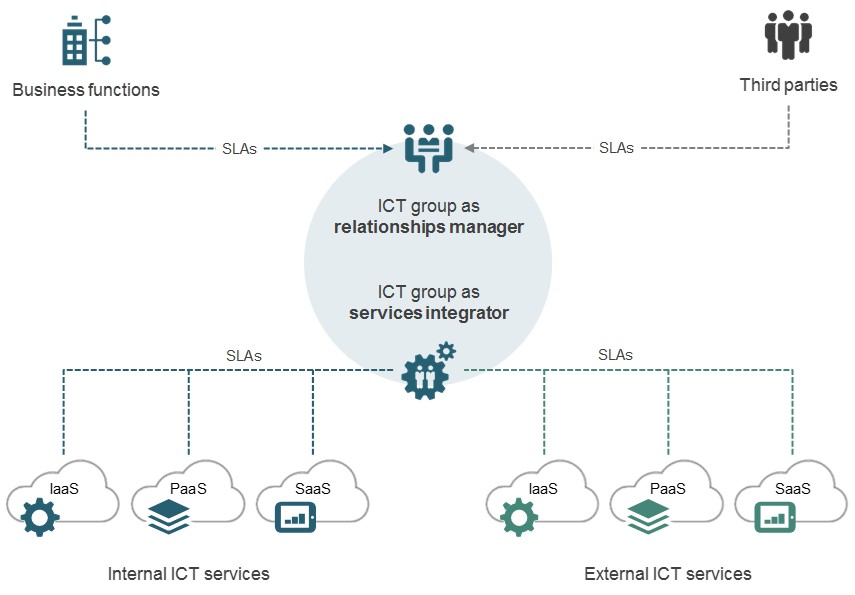

Business relationship management & brokerage – ICT context

In the virtual/consumption economy, the traditional ICT rolls will also change in most organisation to a higher order acting as a broker and integration of services rather than managing sourcing contract.